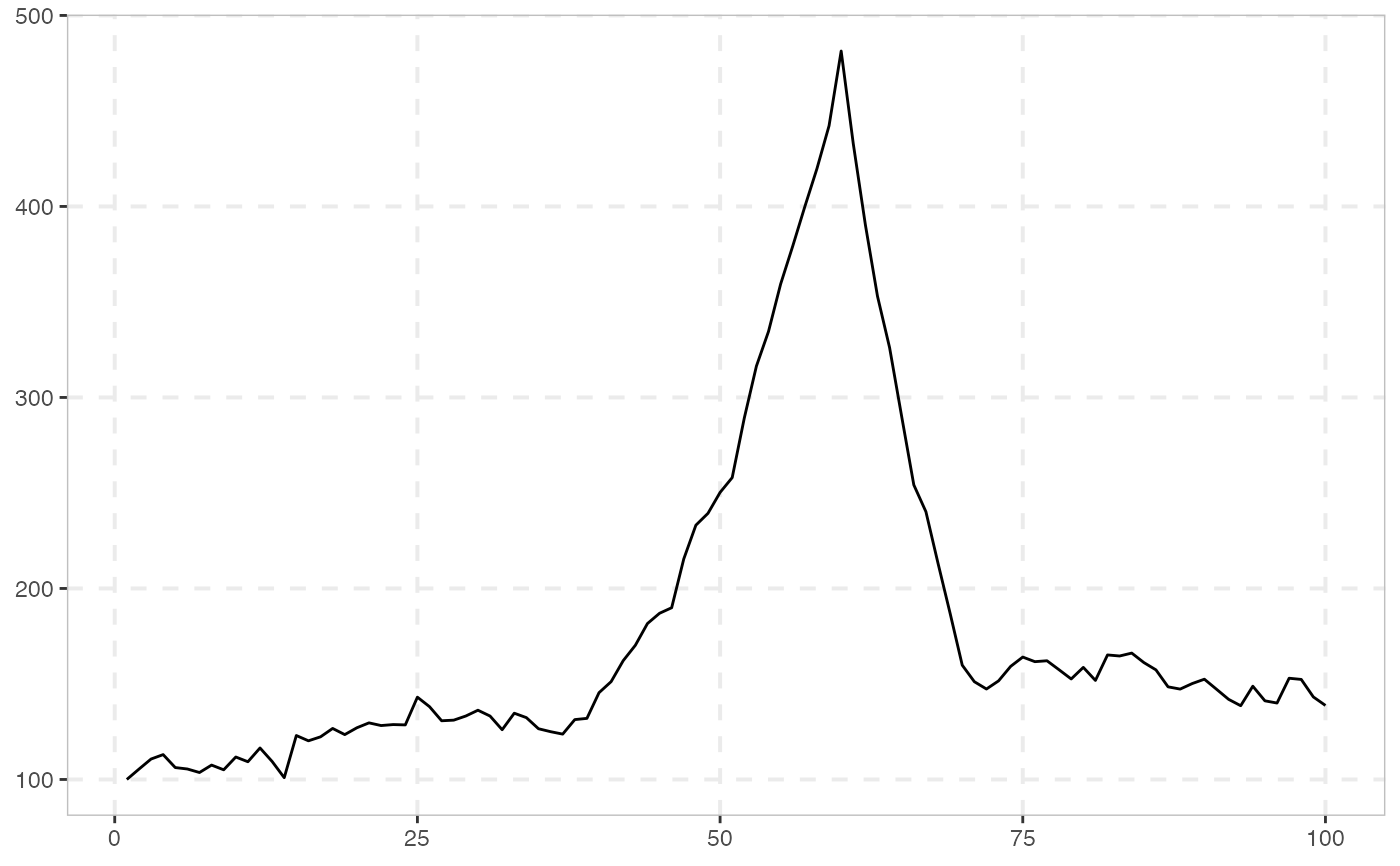

Simulation of a single-bubble process with multiple forms of collapse regime

Source:R/sim.R

sim_ps1.RdThe new generating process considered here differs from the sim_psy1 model in

three respects - Phillips and Shi (2018):

First, it includes an asymptotically negligible drift in the martingale path during normal periods. Second, the collapse process is modeled directly as a transient mildly integrated process that covers an explicit period of market collapse. Third, a market recovery date is introduced to capture the return to normal market behavior.

sudden:withbeta = 0.1andtr = tf + 0.01*ndisturbing:withbeta = 0.5andtr = tf + 0.1*nsmooth:withbeta = 0.9andtr = tf + 0.2*n

In order to provide the duration of the collapse period tr as tr = tf + 0.2n,

you have to provide tf as well.

sim_ps1(

n,

te = 0.4 * n,

tf = te + 0.2 * n,

tr = tf + 0.1 * n,

c = 1,

c1 = 1,

c2 = 1,

eta = 0.6,

alpha = 0.6,

beta = 0.5,

sigma = 6.79,

seed = NULL

)Arguments

- n

A positive integer specifying the length of the simulated output series.

- te

A scalar in (0, tf) specifying the observation in which the bubble originates.

- tf

A scalar in (te, n) specifying the observation in which the bubble collapses.

- tr

A scalar in (tf, n) specifying the observation in which market recovers

- c

A positive scalar determining the drift in the normal market periods.

- c1

A positive scalar determining the autoregressive coefficient in the explosive regime.

- c2

A positive scalar determining the autoregressive coefficient in the collapse regime.

- eta

A positive scalar (>0.5) determining the drift in the normal market periods.

- alpha

A positive scalar in (0, 1) determining the autoregressive coefficient in the bubble period.

- beta

A positive scalar in (0, 1) determining the autoregressive coefficient in the collapse period.

- sigma

A positive scalar indicating the standard deviation of the innovations.

- seed

An object specifying if and how the random number generator (rng) should be initialized. Either NULL or an integer will be used in a call to

set.seedbefore simulation. If set, the value is saved as "seed" attribute of the returned value. The default, NULL, will not change rng state, and return .Random.seed as the "seed" attribute. Results are different between the parallel and non-parallel option, even if they have the same seed.

Value

A numeric vector of length n.

References

Phillips, Peter CB, and Shu-Ping Shi. "Financial bubble implosion and reverse regression." Econometric Theory 34.4 (2018): 705-753.